The Search Fund Model

The Search Fund Process

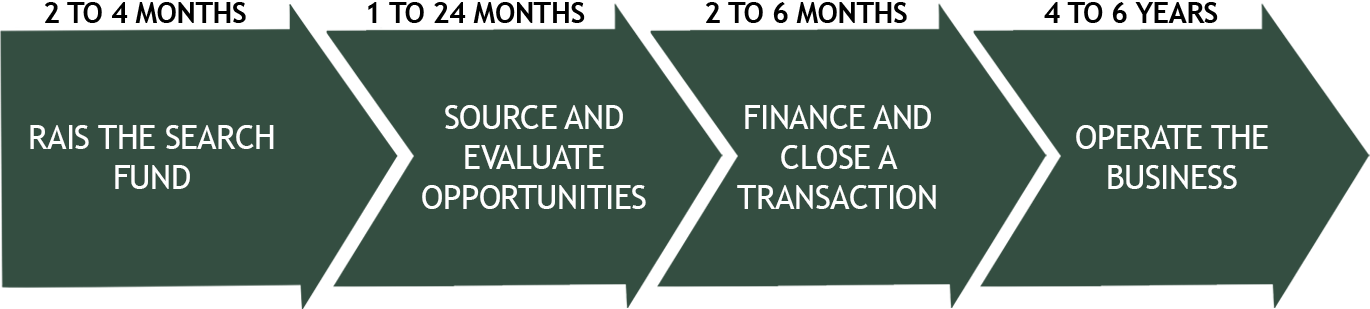

CUEYLO search fund follows a proven model designed to acquire and grow a business over a multi-year horizon. Below is an overview of the key phases and timelines involved.

Raise the Search Fund (2 to 4 Months)

We start by raising the money needed to search for and buy a business. We partner with investors who share our vision and want to support our journey. This phase ensures we have the financial backing to move forward

Source and evaluate opportunities (1 to 24 Months)

Once we have the funds, we begin searching for the right business to acquire. We look at a variety of companies, assessing their potential for growth and alignment with our strategy. This step includes careful research and meeting with business owners.

Finance and close a transaction (2 to 6 Months)

After identifying the ideal business, we work on financing and negotiating the deal.This includes conducting due diligence, defining debt/ capital structure, securing the necessary funds, and closing the transaction. Our aim is to ensure all parties benefit from the deal.

Operate the business (4 to 6 Years)

Once we acquire the business, we focus on running and growing it. Our team works on improving operations, expanding the business, and creating long-term value. We aim to increase the company’s worth over the next 4 to 6 years, at which point we’ll consider selling or continuing to own it.

Understanding Investment Models

Growth Strategy

Venture Capital firms invest in early-stage companies with the aim of driving rapid growth, often focusing on innovation, technology, and scalability.

Search Fund aim for sustainable growth by acquiring and actively managing a single business to optimize operations and value over time.

Private Equity firms seek to maximize returns through growth, restructuring, or cost-cutting, often focused on achieving and exit within a shorter time frame.

Investment Duration

Venture Capital firms typically invest with a timeframe of 5 to 10 years. At the end of this period, they usually seek an exit through an initial public offering (IPO) or an acquisition.

Search Fund Usually have a 7+ year horizon, focusing on long-term value creation before considering a potential exit.

Private Equity firms operate with a 3 to 7 year time horizon, with the goal of achieving a sale or IPO within that period.

Operational Focus

Venture Capital invest in multiple startups, with each receiving stategic support but not the full attention of the fund. Growth potential across a portfolio is key.

Search Fund focus exclusively on one acquired company, providing hands-on operational and strategic management to drive success.

Private Equity firms usually have a large portfolio of companies (10-50) with focus on distributed investments, often resulting in a more hands-off approach for each.

Ownership Structure

Venture Capital firm provides growth capital in exchange for equity, usually keeping founders in operational control while offering guidance through board seats.

Search Fund often acquire 100% ownership of a business, with flexible equity terms allowing for founder retention in some cases.

Private Equity firms typically use buyout strategies with a mix of debt and equity. Founders often exit post-sale, but may retain minority equity.

Management Team

Venture Capital expect the founding team to remain in leadership roles, with active oversight and guidance through advisory or board positions.

Search Fund partners step into leadership roles after acquisition, often aiming for long-term, hands-on management.

Private Equity firms may replace leadership with new management or allow existing leaders to stay for a limited period, focusing on short-term restructuring.